For a while now I have been putting off addressing a problem in the economic simulation for Democracy 4. Basically we have no monetary policy in the game, only fiscal policy, and for a long time, thats been pretty much fine and nobody has complained.

To put things simply, fiscal policy is when the government raises money through taxes and spends it on stuff. Monetary policy is where government messes around with how much actual cash exists in the economy. They are different ways to do things, and there are fierce arguments (what a surprise) about which works best in which situations.

For the lifetime of Democracy 3, its been a moot issue, because outside of Zimbabwe, nobody has made any major monetary policy decisions for a very long time. Inflation has not been a hot political topic for ages, and the terms ‘deflation’ and ‘stagflation‘ have not been in the news for probably forty years. Thus nobody objected to them not being in D3.

But 2020 is not 2013. Since the global financial crisis, a number of policy instruments have become more popular, and the discussion of monetary policy is suddenly very real. The two policies that have been active and also discussed are Quantitative Easing and helicopter money. Both are now in the game…

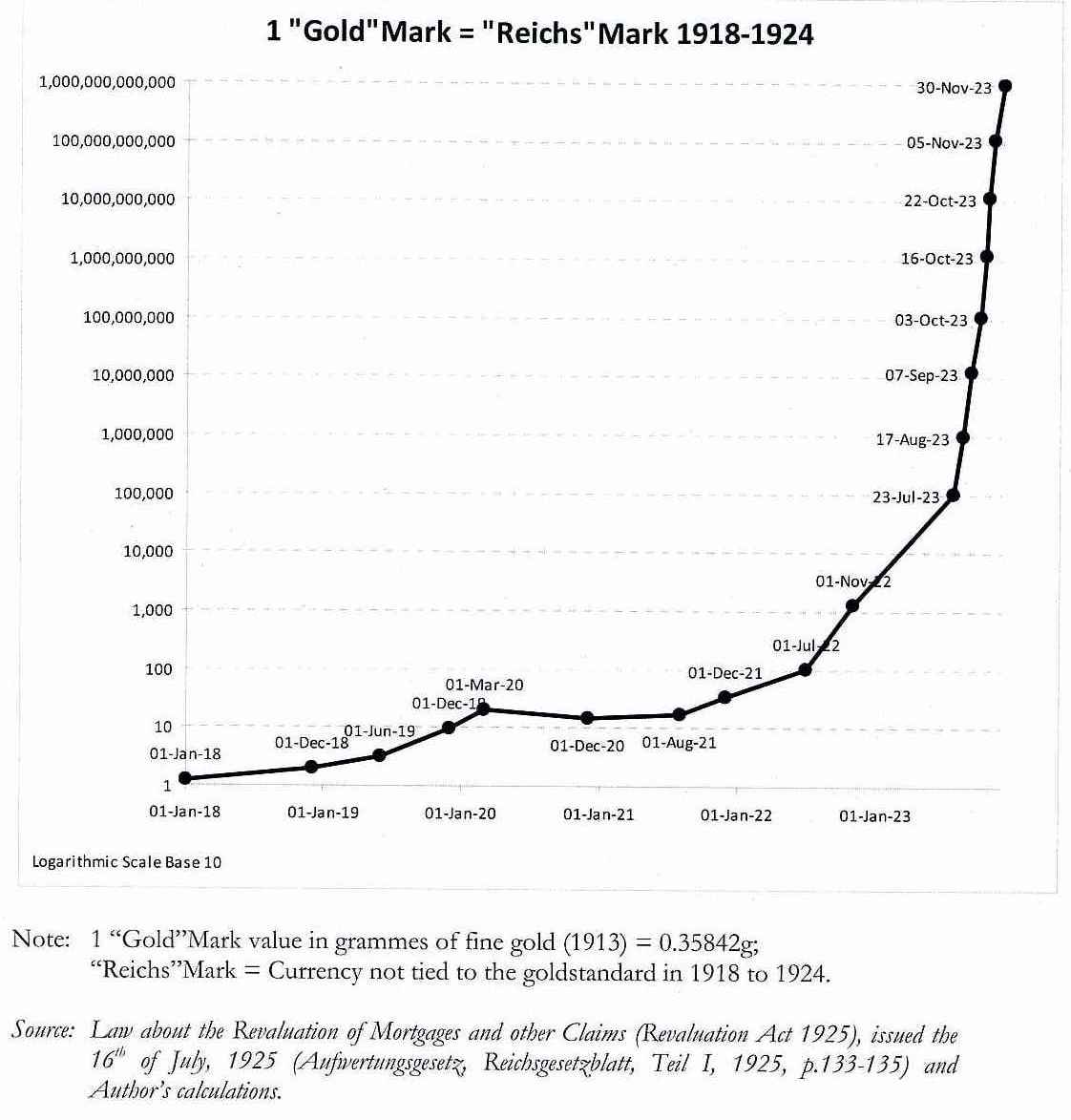

Quantitative easing is basically printing money, although policymakers pretend it isn’t, to avoid comparisons with the Wiemar republic or Zimbabwe, because it has a very bad reputation. QE is a special form of money printing where the central bank pushes a button and gives itself (for example) 100 billion dollars, then buys bonds and other relatively safe assets on the stock market worth 100 billion dollars. No ordinary people see any of this money, but it pushes up the stock market, resulting in higher business confidence, more wealth for stockholders, and with any luck, a more stable and maybe even booming economy!

Obviously this has side effects. This basically causes stealth inflation (possibly not visible because it is used to prevent deflation (prices falling) as a last resort. There is no way to avoid the fact that any form of money printing creates inflation. This makes people will cash deposits worse off (people with some savings) and can drive up prices. It also makes your currency weaker. However, if you have shares on the stock market, you are better off, and arguably it can cause an asset-bubble.

Anyway…

Helicopter money is similar. Its another form of money printing, but you basically hand the money in envelopes to every citizen. This has a similar effect in stabilizing the economy, but it makes the poorest better off (typically everyone gets the same payment), and is not skewed towards wealthy stockholders. The problem with helicopter money is you cannot reverse the process if it goes too far, whereas with QE, you can basically sell the bought assets, then destroy the imaginary money you bought them with, thus reducing the money supply, and stopping inflation going mad. FWIW I am lumping in ‘Peoples QE‘ with helicopter money to simplify things.

So…with those two very quick-and-dirty explanations out the way, how does this fit into Democracy 4?

Both QE and Helicopter Money are ways to IMMEDIATELY boost GDP, and either make the rich/poor happy/sad depending which you pick, that do not cost anything at all. (You printed the cash remember!). Obviously there has to be a catch right?

Well yes… inflation and the eventual risk of hyperinflation (which is catastrophic and rarely recoverable). This means I have had to model both inflation and hyperinflation (I also added a border wall policy at the same time btw :D). These are now in the game, with a variety of inputs and effects and I’m still fiddling with getting the balance right which is HUGELY difficult. (The true economic theories here are amazingly complex and often contradictory so you can imagine what a mess it can all be…).

I have found (so far) that the best way to model the negative effects of inflation is through prices on food and oil. Most countries do at least some importing of oil and food, and this is a way to reflect the broader globalization trend and the impact of your currency weakening against the country from which you buy stuff. (For the US this would be china). To put things bluntly, if Donald Trump gave everybody in the US an extra (printed) hundred thousand USD, then the USD / Yuan exchange rate *should* change, making goods imported from china more expensive.

NONE OF THIS IS 100% CORRECT OR ACCURATE BUT YOU GET THE IDEA.

I am sure there will be very many long, multi-page debates on my forums once the game goes into pre-alpha sales and people with economics degrees, MSCs and PHDs p[lay the game and argue if certain effects make sense or are too strong/weak. This is tough stuff to model in a video game.

And yet… it has to be in Democracy 4. Look at any online politics forum and you will find people (especially on the left of the political spectrum) arguing that the government can print money as an alternative to austerity, and people on the right saying thats nonsense and we have to live within our means. It HAS to be in the game, and I bet loads of people will argue that I’ve done it wrong.

I guess thats game design for you :D